If you’re a homeowner, you must have heard about home improvement loans and remortgaging. Both of them provides access to finance for people who want to make improvements to their existing properties. But both of them are quite different from each other in terms of their working and mechanism. Improving your home by borrowing money is beneficial if it helps you in decreasing the expenses that you might encounter later on. Also, if it boosts the overall value of your property, a loan can be helpful. Due to the fevered speculation that is doing the rounds in the UK property market for Brexit – homebuyers are opting to make improvements to their current properties rather than taking the risk of moving to a new one. To hunker down the finances, “Improve rather than Move” has become the prime motto of most of the homebuyers in the UK.

In this blog, we will discuss:

1. Difference between home improvement loans and remortgaging

2. Why improve rather than move?

3. When should you consider a home renovation loan?

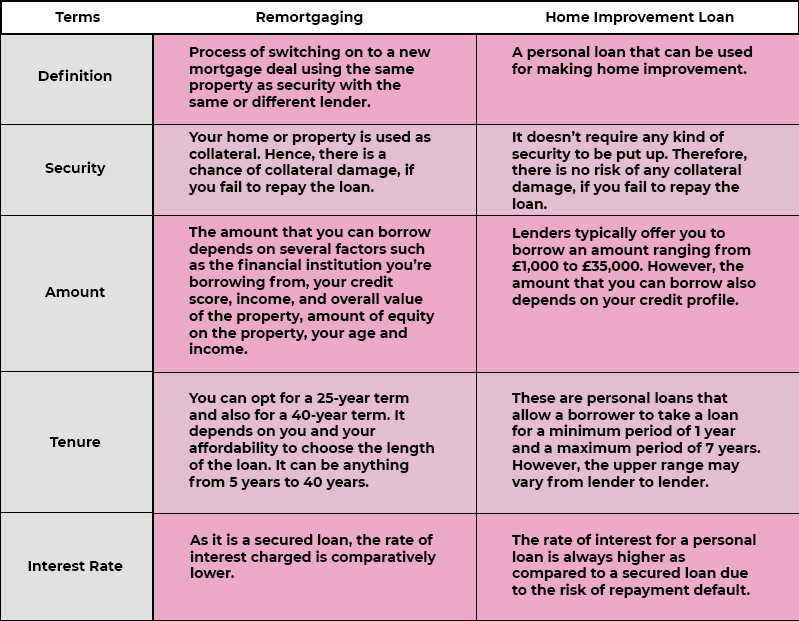

Difference Between Home Improvement Loan and Remortgaging

You must choose a financial product depending on your circumstances and affordability. Whether you want to add a loft conversion or your kitchen needs a new makeover – these products are designed to help you get the most out of your property. Fixing up your home can help you improve the quality of your life as well. Therefore, you must make the necessary upgradations to your property from time to time.

Why Improve Rather than Move?

According to a report published by award-winning business and home insurance company – Hiscox, the number of homeowners choosing to improve their homes has risen fivefold since 2013. Britain is becoming a nation of improvers, and the economy is a major driver of home renovations. Over the last 10 years, the UK local councils have witnessed an increase of 29% in the number of requests made by the homeowners for planning permissions. 36% of homeowners said improving their home is about changing personal circumstances, while 25% of them said that the high prices of properties are a roadblock to purchase a new home. Interestingly, 13% of homeowners said the recent changes in stamp duty is a barrier for moving houses in the UK. Another 8% of homeowners said the reason for their staying put is Brexit uncertainty, and 8% of them are concerned about the rising interest rates.

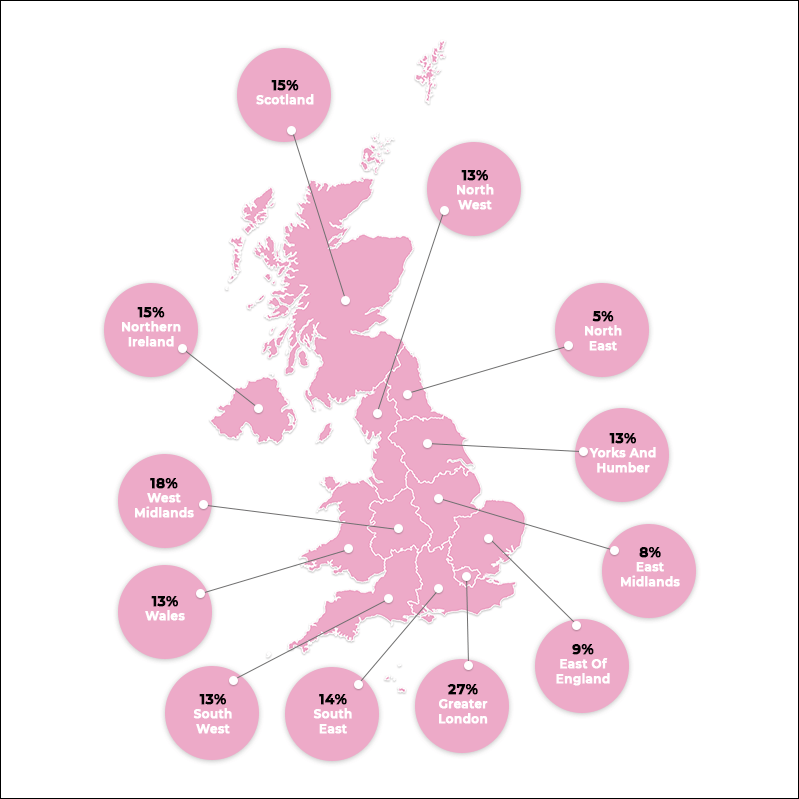

Percentage of homeowners taking the decision to stay put and renovate, instead of moving in 2017 (Regional breakdown)

When Should You Consider a Home Renovation Loan?

Your purpose should be clear before you decide to borrow a Loan on Instalment to renovate your house. If you’re considering to resale your property and that is the reason you want to add value to it – you must use your money cautiously. Inspect your neighbourhood and know what the maximum reselling value of the properties is. Making your home overly expensive may not help it resale.

If you’re considering to borrow money to improve your home and stay put – then know the areas you must invest in to get the most out of it. Style-driven home improvements may boost the overall value of your property in addition to making it alluring. Invest wisely to get healthy returns on it.

Now, coming to “when” should you think about borrowing a loan for this purpose. The answer is your needs and affordability. If you can easily repay the money that you plan to take out – then opting for a personal loan is not a bad idea at all. These loans help you spread the cost of repayments over several months. Therefore, plan your repayment strategy.

Top Takeaway

Extensions, renovations, and specific makeovers can help you in raising the valuation of your property. If you have enough savings for what you have planned to do – then go for it. If you need additional funds to support your idea – a loan is just a click away. Research the housing market, the real estate trends and statistics of your neighbourhood before you step on your plan for better results. Amidst economic turmoil, it is financially sensible and economical to stay put and improve rather than moving to a new house. The estimated cost of moving house in the United Kingdom is £8,885.66, according to comparemymove. When the nation is preparing for a recession, it is better to take care of your finances.

If you want to apply for a Home Improvement Loan with us, without hurting your credit score*, Please Click Here.